Digital Payment Apps Transforming Credit Card Management

Smartphones have transformed the way we fulfill our financial needs, all because of today’s tech generation. Payment apps are transforming our finance management methods, especially with regard to credit card management. These innovative technologies provide us with more control over our expenditures and simplify our financial lives through their several capabilities. This article explores how these apps are constantly upgrading our credit card payments and experience.

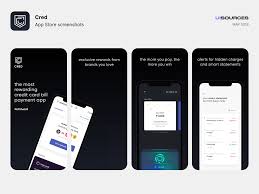

Simplified Credit Card Payments

The most convenient feature of modern payment apps is their ability to streamline credit card payments. For example, the yes bank credit card payment process has been significantly simplified through these platforms. This level of convenience ensures that users never miss a payment, helping them maintain a good credit score and avoid unnecessary charges. Users can now:

- Schedule payments in advance

- Set up automatic payment schedules to avoid late fees

- View payment history and upcoming due dates

- Receive reminders for pending payments

Comprehensive Credit Monitoring

Payment apps have gone beyond mere transaction processing. Many now offer robust credit monitoring features, providing users with a detailed credit card report. These apps help users to make wise credit use decisions by providing simple access to this data, therefore guiding them towards better financial conditions. These reports typically include:

- Current credit score

- Credit utilization ratio

- Payment history overview

- Active credit accounts summary

Enhanced Security Features

With the increase in digital transactions, security has become a top priority. Many payment apps now incorporate advanced security measures to protect users’ financial information. Some even offer a virtual credit card generator feature, which creates temporary card numbers for online transactions. This feature is particularly useful for frequent online shoppers or those concerned about potential data breaches. This provides an additional layer of enhanced and efficient security by:

- Generating unique card numbers for each transaction

- Setting spending limits on virtual cards

- Automatically expiring cards after a set time or single-use

- Preventing exposure of actual credit card details online

Budgeting and Expense Tracking

Modern payment apps often come equipped with powerful budgeting tools. By providing a clear overview of credit card usage, these tools encourage responsible spending and help users stick to their financial goals. These features help users:

- Categorize credit card expenses

- Set spending limits for different categories

- Visualize spending patterns through graphs and charts

- Receive alerts when approaching preset limits

Rewards Management

Many credit cards include rewards programs, and payment apps have simplified tracking and redeeming of these perks. This way of integrating rewards management helps consumers optimize the advantages of their credit cards. Users are able to:

- View the points or cashback earned over time.

- Notifications for unique rewards and offers.

- Transfer points throughout reward programs.

- Multiple options to redeem the rewards, such as coupons and more.

Conclusion:

From streamlining payments to improving security and offering insightful analysis of our consumption, digital payment applications have changed our interaction with our credit cards. These applications should provide even more creative tools as technology develops, thereby easing our financial management and enabling people all over to use credit cards more safely and effectively.