How Are Online Trading Apps Empowering Indian Youngsters?

When teenagers are beginning to enter adulthood, a lot of their time and energy goes in establishing their strong sense of self. Money is an important component that starts to take place in their consciousness and most of them start contemplating how to take control of their own financial world.

We all have been there; there is something about taking charge of your own finances as a youngster. You no longer want to depend on your parents but take care of your wants and needs yourself. However, this sometimes becomes difficult when you are in school or college and the avenues for earning money are limited.

However, the era of online trading apps has changed this scenario significantly. Investment is not just something that adults with a lot of money and power do. Trading has become significantly accessible to people aged 18+ and is now shaping a new era of financially empowered youngsters.

1.Fewer Barriers To Entry

Earlier, investment opportunities was tapped into only by a select group of people who had access to brokers, brokerage money and the knowledge that goes into investing. Naturally, not every common man felt encouraged to invest since that level of financial literacy was not accessible to the masses. Today, not just youngsters, but anyone and everyone can invest.

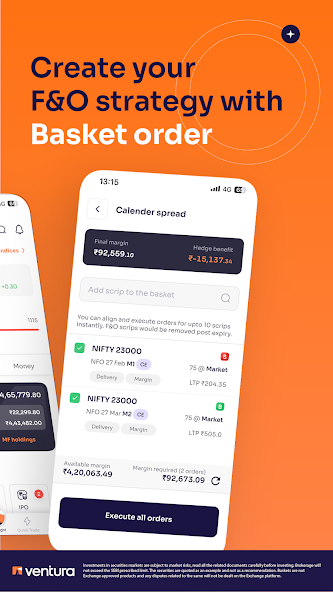

Since young people are more enthusiastic and open to try new things, they have taken the advantage of free or zero brokerage online trading platforms to start investing. One just needs to download a trading app, sign up and they get access to a plethora of financial instruments to invest in. This reduction in barriers to entry to the stock market have encouraged young Indians to start investing.

2.Easy Access To Resources And Knowledge

Earlier, the common belief was that you need to have a lot of contacts and money if you want to start investing. The era of online investment platforms has proved it wrong. Not only can you open a demat and a trading account all by yourself at zero brokerage but you can also access all the knowledge regarding investing online, mostly free of cost.

3.Variety Of Financial Instruments

Another major advantage of an online investing app is the variety of financial instruments and the flexibility it provides. One can start a mutual fund investment with as less as Rs.100 per month. Stocks can be bought for a few hundred rupees and brokerage has been made almost free. This flexibility of choice encourages young students to invest and trade with whatever they have.

4.Encouragement Of Financial Discipline

Habits are formed at an early age. When youngsters start investing early, learn about the nitty-gritties of investment, understand the risks involved, it creates a sense of financial discipline in them which they carry forward in life. It also helps boost their confidence and cultivate good financial habits which teaches them early about the importance of money.

Whether it is a stock investment app or any other trading platform, the youngsters of India have tapped into the full potential of this industry. Today, they have learned to equip themselves with knowledge and invest on their own, further fostering a culture of financially responsible youngsters that have the confidence and skills to become successful investors.