Rethinking Bitcoin Buying: A Derivatives-Based Approach for India

To buy btc in India today doesn’t necessarily mean transferring coins to a wallet. Many Indian traders are adopting a more strategic approach — using INR-settled Bitcoin futures on Delta Exchange to participate in market movements. This lets them avoid the risks of storage, hacks, and regulatory uncertainty while gaining full price exposure.

The traditional mindset to buy bitcoin and hold it in a wallet is slowly shifting. On Delta Exchange, users can take long or short positions through perpetual swaps without owning the actual BTC. This removes the complications of managing wallets or private keys, and makes the entire experience smoother for traders looking for quick market access.

Many traders associate buying bitcoin with long-term investments, but in a volatile market, short-term opportunities often offer better returns. Delta Exchange enables such flexibility with INR-based contracts that mirror BTC prices without needing to buy the coin directly.

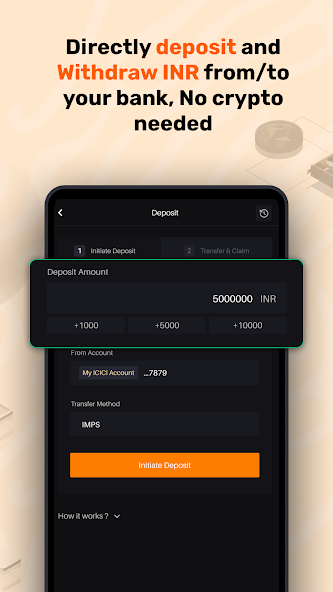

When you buy bitcoin crypto through a spot exchange, you face price slippage, withdrawal limits, and liquidity issues. But on Delta Exchange, futures contracts allow you to make precise entries and exits using advanced tools, all without owning any crypto or converting INR to USDT or USD.

For those who want to buy and sell cryptocurrency regularly, using futures can be a smarter way to reduce risk and gain efficiency. On Delta Exchange, you can open trades, set stop-losses, and book profits without transferring a single token — everything happens within a secure INR environment.

This derivatives-driven model suits the needs of modern Indian traders who value convenience and control. With tools like leverage, cross-margining and real-time risk management, Delta Exchange empowers users to move beyond traditional buying behavior.

It’s important to clarify that Delta Exchange does not support spot trading. The platform is fully designed around derivatives — including futures and perpetual swaps — to give traders more flexible and powerful instruments. This focus enables a hassle free INR based experience without the friction of coin transfers or asset custody.

By shifting the mindset from “buy and hold” to “trade and manage,” Indian users are discovering a more dynamic way to engage with Bitcoin. Delta Exchange provides the tools, infrastructure, and clarity that allow traders to capitalize on market opportunities all while keeping their capital in INR.